Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Balance sheets also play an important role in securing funding from lenders and investors. A company should make estimates and reflect their best guess as a part of the balance sheet if they do not know which receivables a company is likely actually to receive. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts. These ratios can yield insights into the operational efficiency of the company. It uses formulas to obtain insights into a company and its operations.

Owners’ equity section

There are a few common components that investors are likely to come across. Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

What is included in the balance sheet?

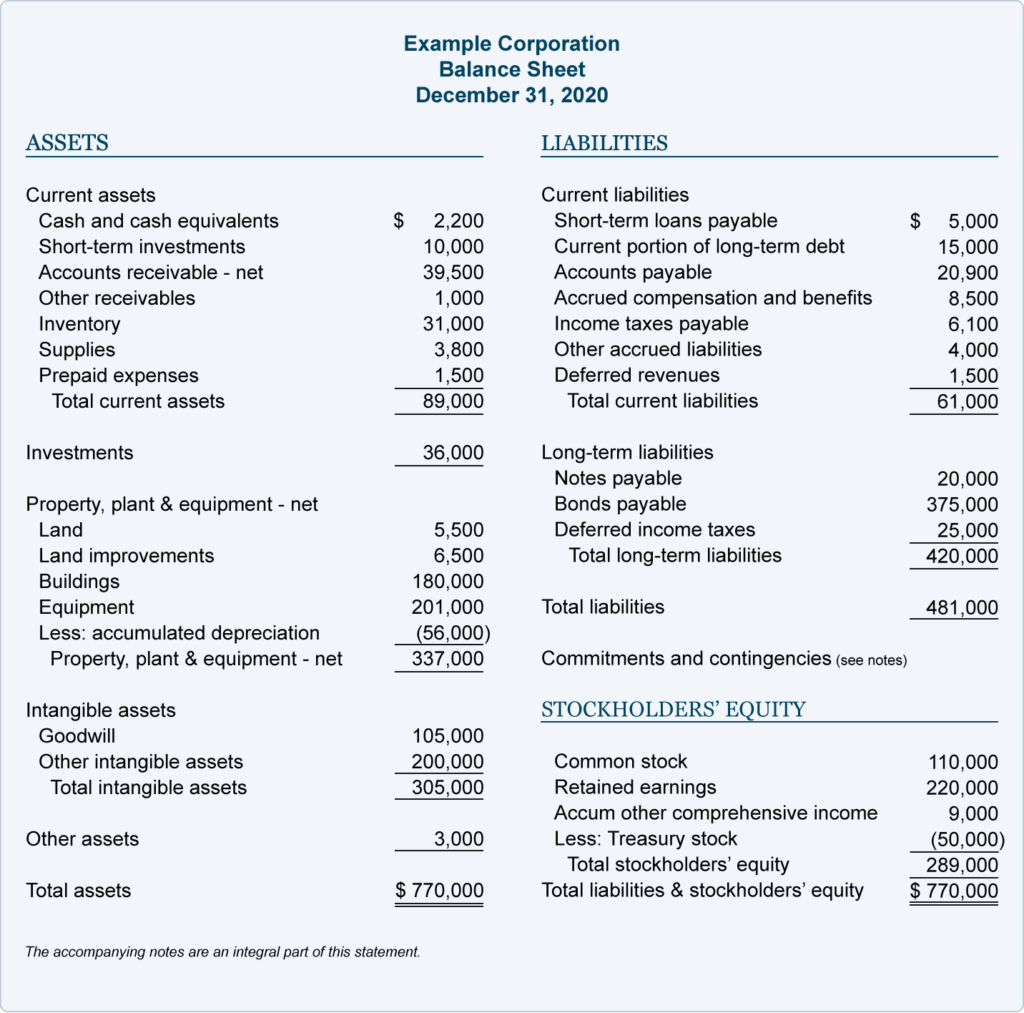

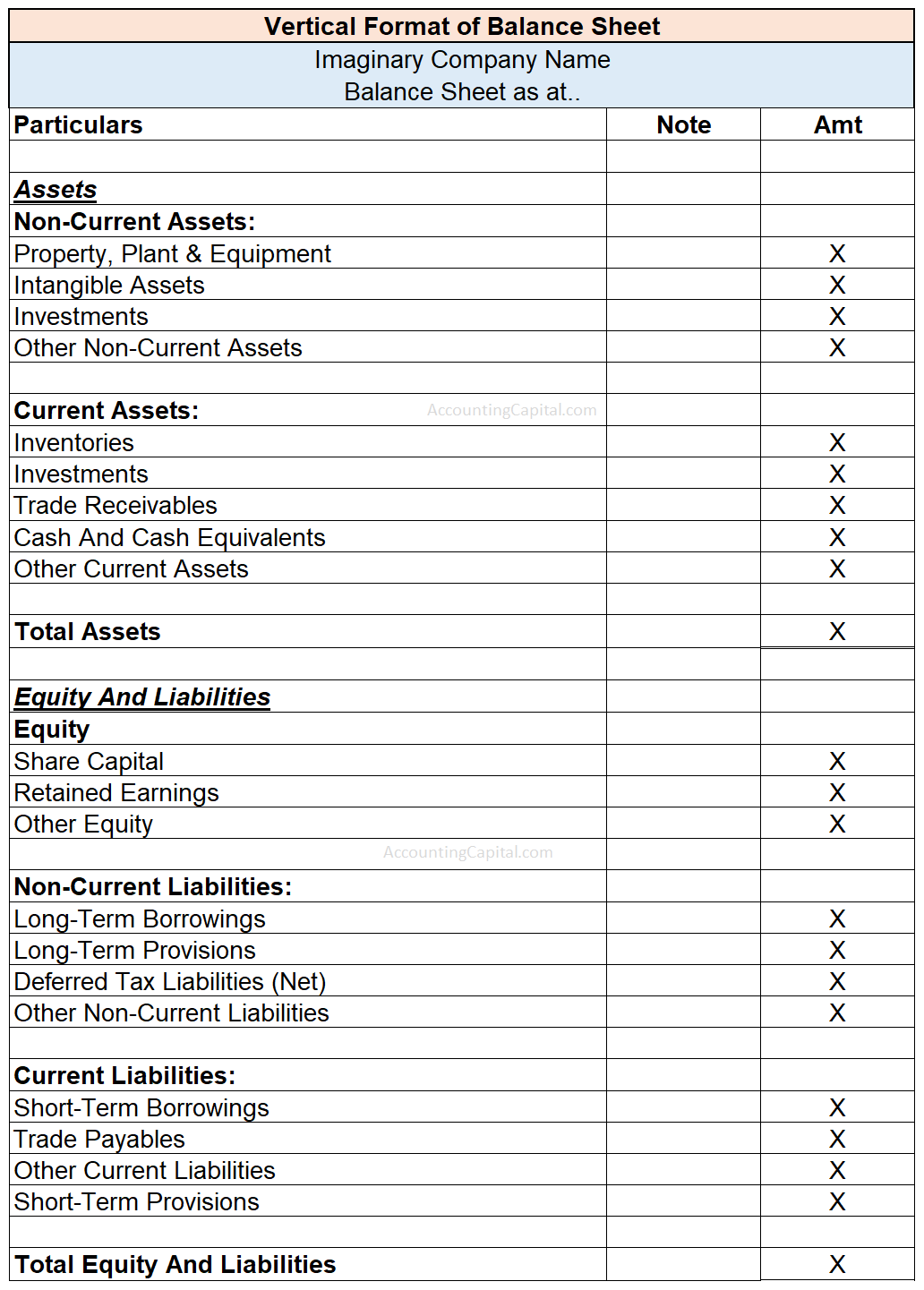

Note that in our basic balance sheet template, the “Total Assets” and “Total Liabilities” line items include the values of the “Total Current Assets” and “Total Current Liabilities”, respectively. The ending cash balance on the cash flow statement (CFS) must match the cash balance recognized on the balance sheet for the current period. If the difference between balance b f and balance c f explained fundamental accounting equation is not true in a financial model—i.e. The balance sheet does not “balance”—the financial model contains an error in all likelihood. Fill out your balance sheet template to calculate your business equity in minutes. With the balance sheet template Google Sheets provides, you’ll be filling in fields with ease.

The Balance Sheet Equation

Companies that report on an annual basis will often use December 31st as their reporting date, though they can choose any date. Tracking of stock inventory can be difficult and this difficulty increases with the largeness of the store, shop, supermarket, and more. Many people use paper but it has been proven to be a very unsafe way to capture such records. A medication list template is a document used by a medical professional to track all the medications that a patient is taking. A financial form used for reimbursing project expenses paid for an institution. A performance appraisal form is used to evaluate employees’ work performance in order to see what they’re doing well and what they need to improve on.

- We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB.

- By reviewing this information, you can easily determine your company’s equity.

- If spreadsheets work best for you, keep things simple with the balance sheet template Excel.

- It’s not uncommon for a balance sheet to take a few weeks to prepare after the reporting period has ended.

- It may not provide a full snapshot of the financial health of a company without data from other financial statements.

With easy to use functions and familiar formatting, it guides you through the balance sheet basics to get you right where you want to be. Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price. Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price.

Retained Earnings

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. Often, the reporting date will be the final day of the accounting period. A company’s balance sheet provides important information on a company’s worth, broken down into assets, liabilities, and equity.

A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. Companies, organizations, and individuals use balance sheets to easily calculate their equity, profits, or net worth by subtracting their liabilities from their assets. By doing so, they can get an overall picture of their financial health. A balance sheet also serves as a company or organization’s financial position over specified time, such as daily, monthly, quarterly, or yearly. As described at the start of this article, a balance sheet is prepared to disclose the financial position of the company at a particular point in time.

If you’re looking for a more concise look at your business finances, check out the balance sheet report from FreshBooks. It provides a summary of your business assets, liabilities and equity so you can have a quick overview of your finances. If you are a current or prospective small business owner, it’s imperative that you track your liabilities and assets. Doing so will ensure you have accurate information regarding how your company invests and spends money. A complete balance sheet allows you to identify areas of concern and patterns in profit and loss.

The balance sheet is a very important financial statement that summarizes a company’s assets (what it owns) and liabilities (what it owes). A balance sheet is used to gain insight into the financial strength of a company. You can also see how the company resources are distributed and compare the information with similar companies. We’ve put together this handy balance sheet template to help you follow a simple balance sheet format.

While current assets can be converted into cash within a year, liquidating non-current assets, such as fixed assets (PP&E), can be a time-consuming process. The two funding sources available for companies are liabilities and shareholders’ equity, which reflect how the resources were purchased. There are two other documents that go alongside the balance sheet and complement the general ledger. FreshBooks offers a variety of free accounting templates for business owners like you who are trying to take their accounting into their own hands. The FreshBooks balance sheet sample will save you time and money on your accounting. Download the template in the format of your choice, and customize it to fit your needs.

Comments are closed.