The economic entity assumption allows the accountant to keep the business transactions of a sole proprietorship separate from the sole proprietor’s personal transactions. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. If you need a refresher course on this topic you can view our basic accounting concepts tutorial here. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

What is your current financial priority?

Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

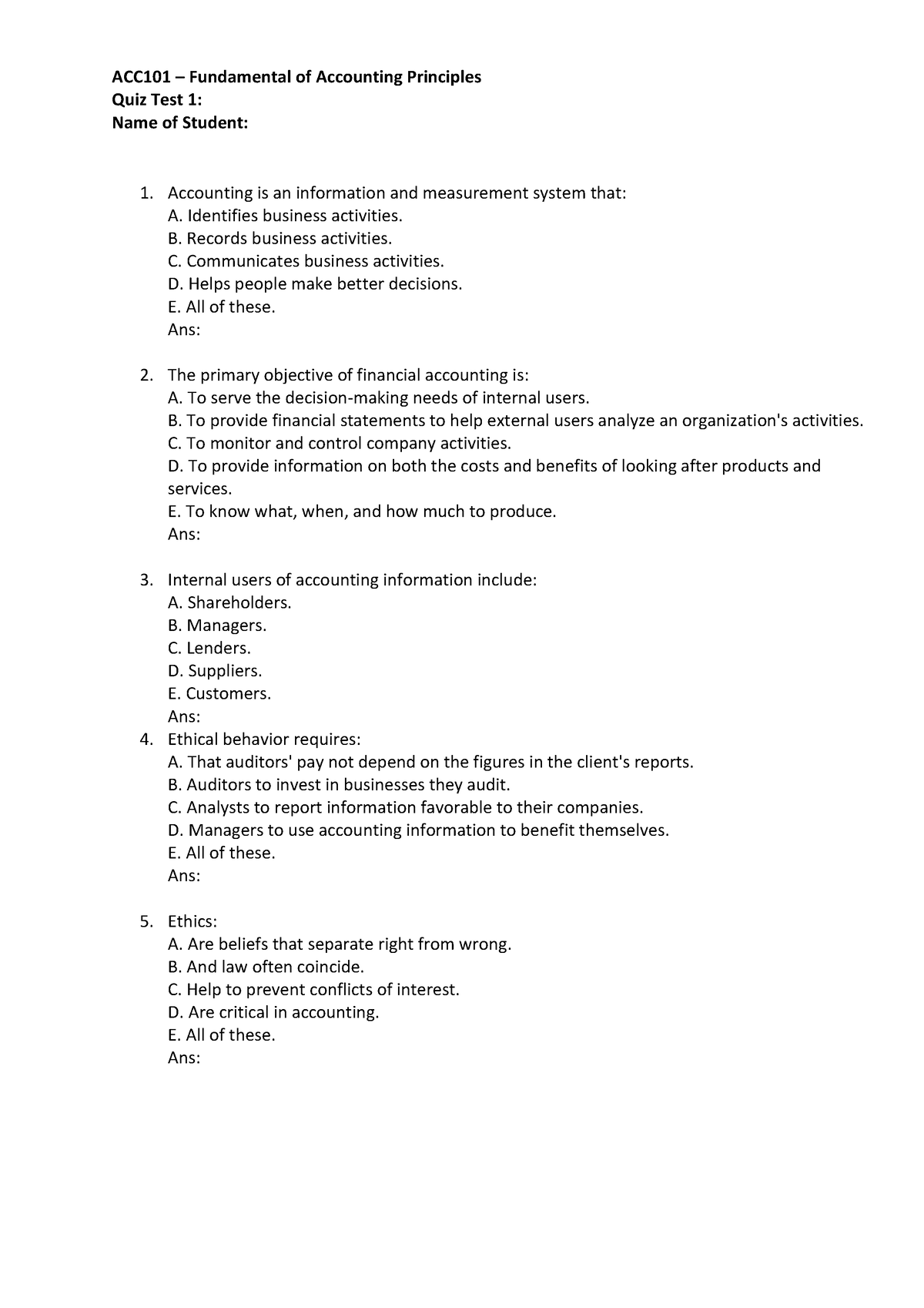

Accounting Quizzes

- There’s no need to feel confused about these basic accounting principles or stressed out because you feel like there’s never enough time to finish all the questions on your accounting quizzes and tests.

- This free accounting principles practice test assesses your knowledge of some of the most common questions that students encounter on their accounting exams.

- Because of this, the accountant combines the $10,000 spent on land in 1980 with the $300,000 spent on a similar adjacent parcel of land in 2023.

- To make the topic of Accounting Principles even easier to understand, we created a collection of premium materials called AccountingCoach PRO.

- When a cause-and-effect relationship isn’t clear, expenses are reported in the accounting period when the cost is used up.

More importantly, did you really know the answers, or did you have to guess at some of the questions? Ideally, you should be able to answer those accounting questions with ease. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Learn At Your Own Pace With Our Free Courses

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Common accounting decision-making models include the rational decision model, the incremental decision model, and the satisficing decision model. Each of these models has its own set of steps that should be followed when deciding. Receive instant access to our entire collection of premium materials, including our 1,800+ test questions.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Except for certain marketable investment securities, typically an asset’s recorded cost will not be changed due to inflation or market fluctuations.

As a result of this principle, a company’s financial statements will include many disclosures and schedules in the notes to the financial statements. To make the topic of Accounting Principles even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our accounting principles cheat sheet, flashcards, quick test, and more. In accounting, decision-making is the process of choosing between two or more courses of action to achieve the desired outcome.

Examples are advertising expense, research expense, salary expense, and many others. Accountants assume that a company’s ongoing complex business operations and financial results can be divided into distinct time periods such as months, quarters, and years. Accountants use the information to make decisions by analyzing data and trends. This information can come from Financial Statements, internal reports, surveys, and other sources. By analyzing this data, accountants can make informed decisions to help the company achieve its goals.

The justification is that no lender or investor will be misled by a one-time expense of $200 instead of say $40 per year for five years. Another example is a large company’s reporting of financial statement amounts in thousands of dollars instead of amounts to choosing a retirement plan 403b tax sheltered annuity plan the penny. Fees earned from providing services and the amounts of merchandise sold. Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery.

Comments are closed.